Capital Credits Events 2023

Craighead Electric Cooperative is returning $1.4 million to its members this year and you can claim your check at one of the three events in June.

In business, the phrase “bottom line” usually refers to the profits. It comes from the concept of a financial report known as the income statement or the statement of revenues and expenses.

In business, the phrase “bottom line” usually refers to the profits. It comes from the concept of a financial report known as the income statement or the statement of revenues and expenses.

In the income statement, revenues for a given time period are summarized and then expenses for the same period are listed. When expenses are subtracted from revenues, the money that remains represents net profit and is shown as the last line of the statement. However, with a cooperative, it does not work that way.

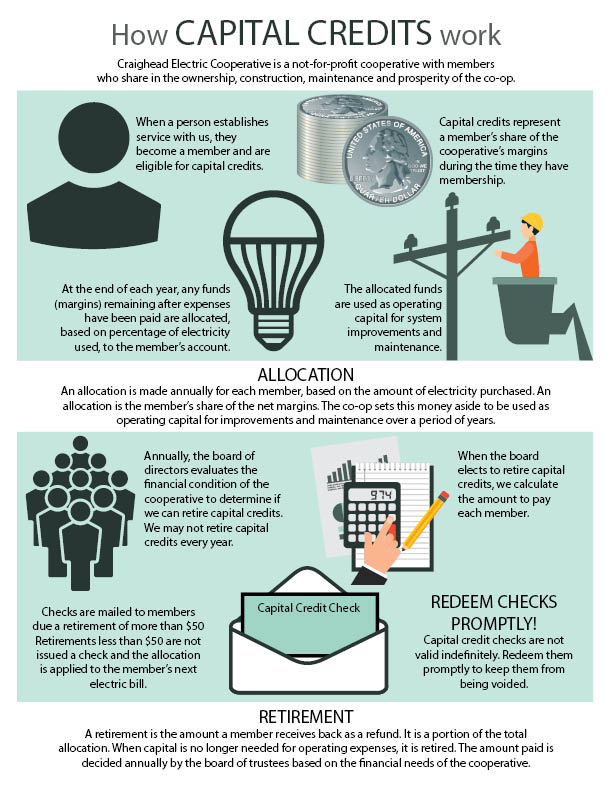

Our income statement has a bottom line, but it isn’t called profit. It is called the margin. Why? Because cooperatives don’t exist to make a profit.

The money that is left over when expenses are subtracted from revenues does not belong to the cooperative. It belongs to the members of the cooperative. It’s their money, and they are going to get it back.

That’s right, cooperative members get their share of this profit allocated back to them as capital credits. The co-op may keep it for a period, to use it temporarily as working capital, but eventually, those margins are returned to members, either through lower electric bills or as a check written directly to the member. The concept is an essential element of the cooperative business model: Margins belong to the members.

You won’t ever see an Investor Owned Utility returning profits to customers. They exist to benefit their owners, the shareholders. And you won’t see municipal utilities returning profits either. They keep the money to use for other community services.

Each year the decision to pay capital credits is decided by the Board of Directors based on the financial health of the Cooperative. During some years, a Cooperative may experience high growth in the number of new accounts added or severe storms may result in the need to spend additional funds to repair lines. Both events may affect the funds needed to maintain and operate the Cooperative in which event the Board may defer any refunds of capital credits in that year. However, members do not lose capital credits, they are simply deferred until such time as the Board determines that it is proper to pay them for a particular year.

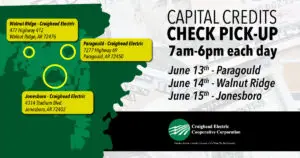

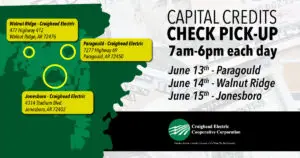

Craighead Electric Cooperative is returning $1.4 million to its members this year and you can claim your check at one of the three events in June.

To celebrate our 85th year in business, we are hosting three capital credit check pick-up events: 7:00 A.M. to 6:00 P.M. June 8th at the Jonesboro headquarters, June 15th at the Paragould district office, and June 22nd at the Walnut Ridge district office.